On October 30, 2015, the Securities and Exchange Commission adopted crowdfunding (CF) rules, as authorized and directed by the Jumpstart Our Business Startups Act (JOBS Act) of 2012. The CF rules represent a dramatic departure from the pre-existing federal securities regulation scheme relative to the ability of private companies to raise small amounts of capital. Under these rules, issuers will be able to offer and sell securities to an unlimited number of persons without regard to their financial sophistication. The rules create a new class of financial intermediary (the funding portal) through which these offerings may be completed. And, the holders of the securities issued in a CF offering will not count against the number of record holders that could ultimately trigger registration of the class of securities under the Securities Exchange Act of 1934 (1934 Act). While the CF rules enable a new funding opportunity for startup companies, we believe that serious questions exist as to whether CF offerings will be widely adopted by technology and life science startups. We offer some observations in this regard at the end of this memorandum.

Broadly speaking, the CF rules contain two sections, one pertaining to issuers and the other to intermediaries. We believe that understanding the former will be of greatest interest to startup companies and the funding sources that support them. Accordingly, this memo provides an overview of the key provisions of the CF rules for companies issuing securities in such offerings.

These key components of the CF rules are:

Effective Date. The effective date for the rules allowing CF offerings is May 16, 2016. There is an earlier effective date, January 29, 2016, for registration as a funding portal through which offerings can be conducted, so that potential issuers will have advance notice of intermediaries capable of serving in this role.

Ineligible Issuers. Companies with a class of securities registered under the 1934 Act, foreign issuers, issuers that do not have a specific business plan, issuers that are delinquent with their existing crowdfunding reporting and “bad actors” (using essentially the same definition as applies to offerings under Regulation D) are not eligible.

Amount Sold. The aggregate amount sold in any 12-month period may not exceed $1.0 million of gross proceeds (i.e., proceeds not reduced by the amount of fees paid to an intermediary). Importantly, this limit applies just to securities sold under the CF rules, and securities sold under other exemptions (such as existing private placement exemptions section 4(a)(2) and Regulation D) will not count against this limit.

Any Kind of Investor and Security. There are no requirements, whether in terms of financial sophistication or net worth or individual or entity status, applicable to persons allowed to purchase. Further, any type of security, debt or equity may be sold.

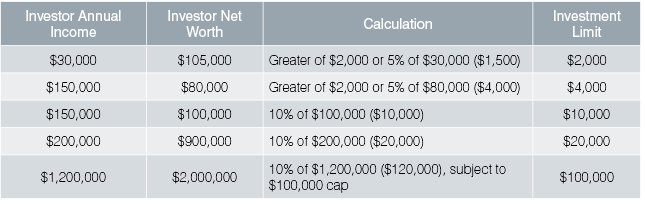

Purchaser Limits. While there are no financial limits on investor eligibility, there are financial limits on an investor’s allowed level of participation.

- Persons with either annual income or net worth below $100,000 may invest the greater of (i) $2,000 or (ii) 5% of the lesser of their annual income or net worth.

- Persons with both annual income and net worth equal to or above $100,000 may invest 10% of the lesser of their annual income or net worth.

These are the aggregate limits on the amount a person can invest in any 12-month period, not limits on investment in individual offerings. Further, regardless of an investor’s financial status, no more than $100,000 may be invested in CF offerings in any 12-month period.

The SEC provided the table illustrating these limits that appears at the end of this memo.

Disclosure Required in Offering. Issuers must file a Form C with the SEC containing prescribed information about themselves and the offering, and must provide such information to the intermediary and investors. These disclosure items include:

- Use of proceeds

- Target size of the offering

- Offering price or how the price will be determined

- Information regarding directors and officers

- Issuer’s capital structure, including identity of 20% shareholders

- Existing indebtedness

- Related party transactions

- Description of other exempt offerings

- Risk factors

- Transfer restrictions

- Narrative discussion of financial condition

- Number of employees

- Intermediary compensation

The most significant of the disclosure requirements is likely to be that regarding financial statement disclosure. This requirement is stratified by offering size as follows:

- Offerings of $100,000 or less: Provide tax items for the most recent year and GAAP financial statements for the past two years from the issuer’s federal income tax returns, and GAAP financial statements for the past two years, as certified by the issuer’s principal executive officer (PEO).

- Offerings of more than $100,000 but not more than $500,000: Provide GAAP financial statements for the past two years reviewed by an independent public accountant.

- Offerings of more than $500,000: Provide GAAP financial statements audited by an independent public accountant; provided that if the issuer has not previously sold securities in a CF offering, these financial statements need only be reviewed.

In a case where reviewed or audited financial statements are not required but are available, they must be provided.

Ongoing Reporting Requirements. Issuers that have completed a CF offering must file an annual report within 120 days of the end of their fiscal year. Key among the disclosures required in these reports is, once again, the required financial statements. In the annual reports, the required GAAP financials need only be certified by the PEO, and there is no requirement for accountant review or audit. Once again, if reviewed or audited financial statements are available, they must be provided. The issuer must continue to make these reports until (1) it has filed one annual report and it has fewer than 300 holders of record or (2) it has filed three annual reports and has total assets less than $10 million. Of course, the issuer’s reporting would also terminate if the issuer becomes a reporting company under the 1934 Act.

Exemption from 1934 Act Reporting Standards. Securities issued in CF offerings are exempt from the record holder count (2,000 holders of record or 500 unaccredited holders of record) for section 12(g) registration under the 1934 Act, so long as the issuer stays current with respect to its CF reporting, has total assets less than $25 million as of the end of its last fiscal year and has engaged a registered transfer agent. If an issuer’s assets rise above $25 million, the exemption of securities issued in CF offerings will terminate after a two-year transition period.

State Preemption. The JOBS Act itself preempts state securities laws’ registration and qualification provisions for CF offerings.

Restrictions on Transfer. Securities purchased in a CF offering cannot be transferred for one year, subject to limited exceptions.

Sales Effected on Allowed Intermediary. A CF offering must be completed on an allowed form of intermediary. A registered broker is eligible to serve as such an intermediary. However, an underlying premise of the rules is that some persons who might be willing to act as intermediaries may not be willing to subject themselves to the full range of broker regulations. Accordingly, the CF rules create a new class of financial entity, a funding portal that is also eligible to serve. The CF rules contain a significant regulatory framework for entities intending to act as an intermediary. Some of the most significant of the host of regulatory provisions include:

- SEC and FINRA registration for intermediaries not already registered as brokers

- Account opening procedures for potential investors, including providing educational materials and measuring the investor’s investment limits

- Maintenance and transmission of funds

- Limits on advertising and making investment recommendations

- The requirement to bar an issuer if the intermediary has a “reasonable basis” for believing that the issuer or offering presents the potential for fraud

Some commentators question whether the regulatory burden imposed upon intermediaries will significantly inhibit the development of intermediaries and, ultimately, of an active CF marketplace.

As noted above, we believe that serious questions exist as to whether CF offerings will be embraced by companies that have obtained, or aspire to obtain, traditional venture capital backing. These include:

- The requirement to publicly file the company information required by the CF rules.

- The potential for “backing” into reporting status under the 1934 Act for an issuer that acquires more than $25 million in assets after completion of a CF offering.

- The usefulness as a funding opportunity of this exemption, which is limited to $1 million in a 12 month period.

In addition to these questions relating to issuer requirements, it is not clear at this time that companies will come forth to serve as intermediaries. We intend to monitor the progress, or lack of progress, in the establishment of intermediaries under the CF rules, as the existence of intermediaries is a precursor to the development of a CF market. If appropriate intermediaries emerge, and the technology and life science community we serve evidences a meaningful interest in this unique, but limited, financing alternative, we will provide further guidance on the details of the CF offering process.

The chart below illustrates a few examples: