Earlier this year, we organized and led a workshop at the Global Corporate Venturing & Innovation Summit in Monterey, California to discuss best practices for starting and running a corporate venture capital (“CVC”) program. This workshop was based on our extensive collective experience organizing, operating, and advising a significant number of CVC programs across industries and stages of development. We focused on surfacing the various alternatives for structuring a corporate venture practice as well as steps and considerations for implementation and execution of an effective CVC investment program.

The goal for the presentation was not only to provide a general framework and guidance for companies considering launching an internal corporate venture program (or expanding an existing program), but also how to articulate to senior members of an organization the strategic benefits of corporate venture investments.

A brief summary of the presentation and a few of the key takeaways follow. As we noted in our presentation, this is a generalized summary and analysis — creating, structuring and implementing a CVC investment program is much more complex due to the need to develop and align the particular strategic elements of a CVC program with the needs of a complex parent organization.

Selling CVC Internally

Every industry is threatened and affected by disruption. This is evident by the fact that the average lifespan of companies listed on the S&P 500 decreased by 66% since 1960, according to Innosight and Standard & Poor’s. As a result, nearly all executives believe that innovation is a top priority for their corporations, with the vast majority dissatisfied with the performance of their innovation programs (according to surveys by PwC and McKinsey).

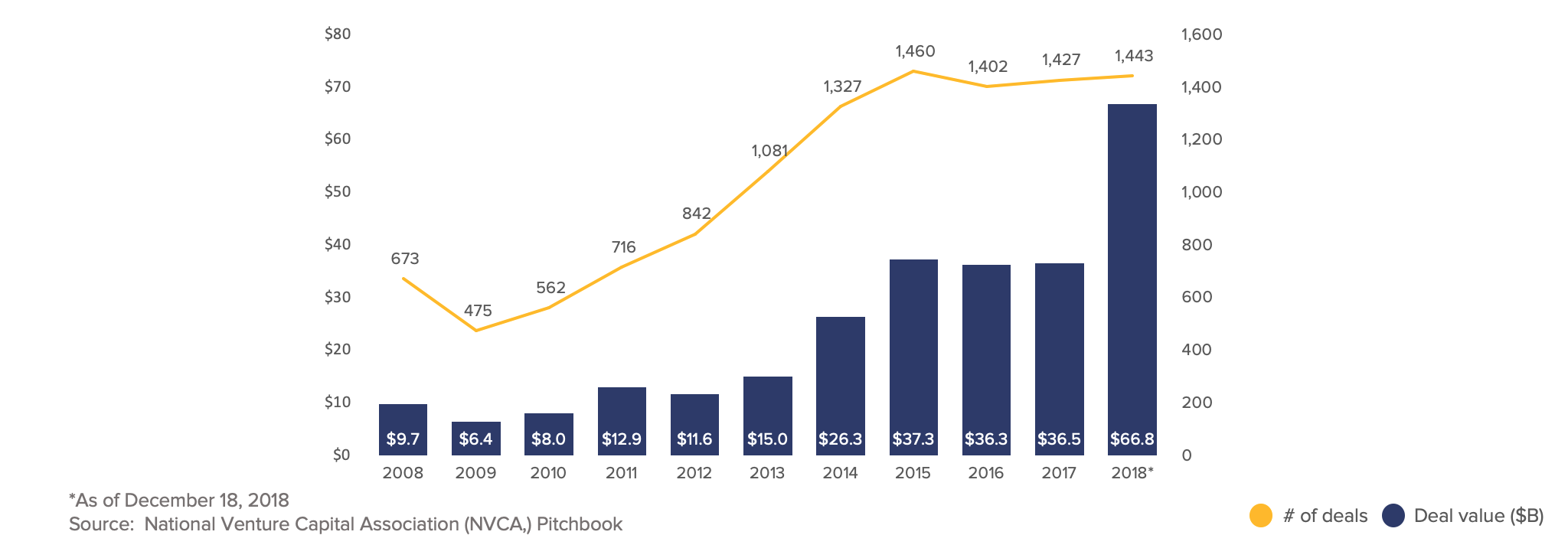

As the need for rapid innovation has increased, corporate venture capital has emerged as a leading tool because it allows companies to explore external opportunities and partner with external innovators, while still preserving the flexibility to bring such innovations in-house at the appropriate time via R&D, business development and acquisitions. Companies across diverse industries have increasingly embraced active corporate venture capital investment programs, resulting in corporate participation in $66B of venture investments across nearly 1,500 deals in 2018 (based on data provided by NVCA and Pitchbook).

Corporate venture capital is primarily about innovation, competitive advantage and survival. The 10+ year growth trend in CVC deals and investment dollars shown above is not a reason to build or expand a CVC program, but such growth suggests that corporations increasingly look to CVC to participate in the innovation and disruption facing their respective industries.

For those seeking to obtain internal alignment and support for a new or expanded CVC program, “following the herd” is of course not an adequate business rationale. But understanding the underlying reasoning for the growth in CVC, the strategic benefits corporations seek and obtain by operating dedicated CVC programs, and the different ways in which a CVC program could be structured to provide strategic benefits to an organization, are entry points for beginning to gather support for launching or expanding a CVC program.

Building it Strategically

We discussed the importance of defining objective and quantifiable strategic goals in determining the appropriate corporate and operational structure for any new corporate venture fund. Building the appropriate structure for a CVC fund requires maximizing both financial returns and strategic alignment with the company’s business needs, including determining how closely the corporate venture fund will coordinate with business units.

Operations and Decision Making

Key considerations include who will have ownership over investment processes, who will run the fund operations on a day-to-day basis, and the level of autonomy the fund will have relative to the larger parent organization. Certain funds are structured with oversight from upper management or a specific parent business unit, while others optimize strategic and financial decisions with a dedicated corporate venture team along with participation from other stakeholders from the larger organization. Similarly, on a day-to-day basis, certain funds assign management from the larger organization, while others either hire an external team or have a combination of internal and external managers to facilitate balanced financial and strategic alignment. Autonomy also varies along a similar spectrum, with certain companies providing full autonomy to the fund to make investments subject to defined parameters and thresholds, while other companies provide more limited autonomy to identify and negotiate proposed investments with a separate investment committee providing final approval.

Size and Funding Commitment

Determining capital allocation and parameters for the number of investments and investment period helps determine the size and structure of the program and team. While considerations vary based upon the goals of the parent organization, it’s important to align the size of the program with the expected stage of target investments. For example, earlier stage investments generally require less capital upfront and thus a smaller investment budget in the early years whereas later stage investments generally necessitate larger upfront checks and thus a larger fund is more appropriate for building a diversified portfolio.

Compensation and Performance Metrics

Compensation structures are important for attracting, retaining, and motivating an effective investment team. Compensation for corporate venture teams traditionally tie compensation to achievement of ROI objectives or other defined strategic metrics. Defining key performance metrics is critical for strategic alignment between the corporate venture fund and the parent entity. In addition to financial return, other common metrics include number of targeted investments within a defined industry, development of new commercial relationships between portfolio companies and parent business units, and acquisitions of portfolio companies, either by the parent entity or other third parties.

Legal Structure

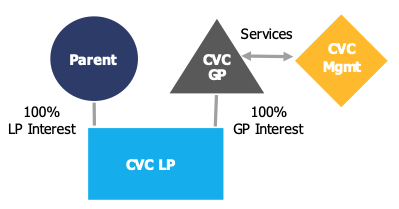

1. Single Limited Partner: the graphic below reflects a traditional venture capital structure, with the parent entity as a single limited partner with limited governance rights and obligations. This fund can be structured to require investments within defined parameters that align with the parent entity’s corporate strategy, but typically operates with greater independence than other structures.

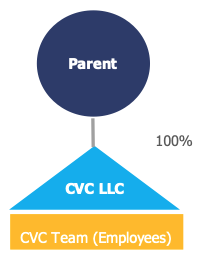

2. LLC Subsidiary: the graphic below reflects a structure whereby the corporate venture fund acts as a wholly-owned subsidiary of the parent entity. In this scenario, typically the investment team has some level of autonomy related to investing sourcing, evaluation and execution, but will typically report to and seek approval from a separate investment committee or executive team for certain investment matters.

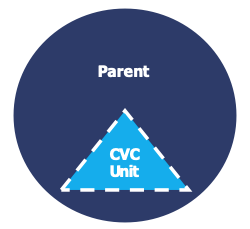

3. Fully Integrated: the graphic below reflects a structure whereby the corporate venture team consists of investment professionals working directory for the parent entity, with each investment requiring specific support from a specific parent business unit.

Running it Effectively

Running an effective CVC investment program requires the implementation of best practices seen at long-established successful corporate venture capital funds. This includes:

1. Setting up a CVC program with a clear investment thesis that aligns with the strategic objectives of the parent company;

2. Building the investment infrastructure of team members and internal/external support structures; and

3. Developing a robust deal pipeline and process to evaluate, close and manage investments.

We also discussed the importance of effective internal and external communication.

Internal communication, regardless of fund structure, incorporates day-to-day messaging with the investment team as well as periodic but consistent communication with the parent entity, both through an investment or advisory committee and the executive team. Successful funds develop a cadence of weekly internal meetings to discuss management of the deal pipeline, execution and portfolio management, as well as monthly or quarterly meetings with the investment committee to and/or the executive team to discuss investment strategies and goals for transferring key learnings and insights to the parent’s core business.

External communication includes external promotion of the fund’s practices as well as ongoing active involvement with portfolio companies. Successful funds develop a comprehensive external messaging plan, including an investment mission and outreach plan to connect with startups and other members of the related ecosystem. Creating and delivering a comprehensive outreach plan will add credibility to the fund, reinforce support from the parent entity as well as drive deal flow and key relationships. Successful funds also strive to be a valuable investor to their portfolio companies, including Board meeting attendance and ongoing advisory roles as well as help with internal and external business development.

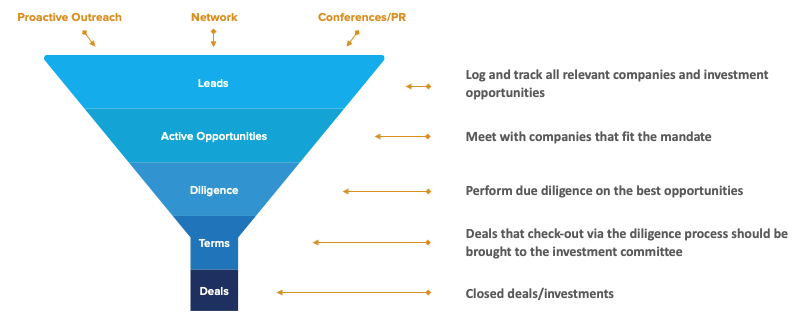

Of course, running an effective CVC investment program requires discipline in developing and managing a quality deal pipeline. We discussed how different CVC programs network in a particular industry ecosystem, develop a qualified deal pipeline, complete the vetting process to qualify companies as potential investments ,and then compete to win deals. We also discussed the importance of CVC programs positioning themselves for success by ensuring that their organizations can move through the deal process at customary “venture speed.”

A Final Thought

A final thought that we shared and discussed at our workshop is the often-overlooked strategic assets that CVC programs bring to their portfolio companies vis-à-vis their venture capital peers. These include a broader depth of non-financial resources, the ability to be a customer or other collaboration partner, and often a longer investment time horizon. The best CVC programs use these strategic assets to the benefit of their portfolio companies, which can help de-risk investment opportunities and bring greater strategic benefit to the parent company. When building a new CVC program, begin with the mindset of “paying it forward.” This approach can help build trust and support, which are critical elements for setting the fund up for success, both strategically and financially.

Originally published June 19, 2019 on the Global Corporate Venturing website.