中文

Background

In May 2015, we published our first survey of the terms of unicorn financings. That survey covered financings undertaken by US based unicorns in the 12 month period ended March 31, 2015, and is available at www.fenwick.com/unicornsurvey.

This is our second unicorn survey and it covers financings undertaken by US based unicorns during the 9 month period ended December 31, 2015. We believe that it covers virtually all such unicorn financings that occurred during the period.

The purpose of this survey is to provide information on the current terms of unicorn financings, and to identify trends in changes in those terms over time. For information on how the valuations and terms of late stage financings affect subsequent IPOs, see our recent survey at www.fenwick.com/termseffectsurvey.

Overview of Results

The highlights of the results of our survey are as follows:

- At a high level, the results of this survey are similar to the results of our prior survey. The main difference is that the number of unicorn financings increased in the current period, despite the current survey covering a shorter period of time than the prior survey.

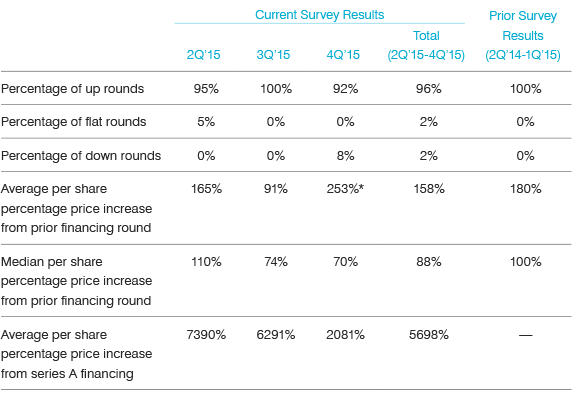

- However, upon further analysis, the beginning of the period covered by the survey was markedly stronger than the end of the period covered by the survey.

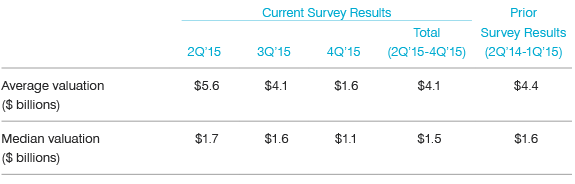

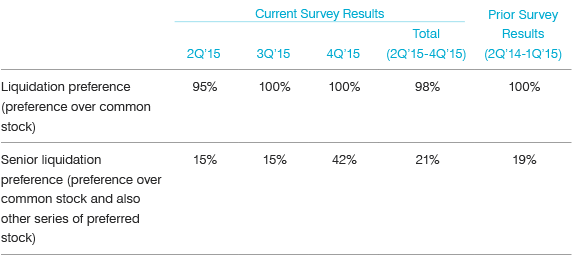

- This difference was especially noticeable in the fourth quarter, which saw a significant decline in the number of financings and valuations, and a significant increase in the use of more investor friendly terms such as senior liquidation preferences, IPO protection terms and upside benefits.

- An interesting aspect of the fourth quarter financings is that half of the financings had valuations in the $1.0-1.1 billion range. This could signal that companies were trying to attain a unicorn valuation, and may have been willing to be more flexible on other terms to attain that valuation. If so, this could have contributed to the more investor friendly terms in the fourth quarter.

- For the survey as a whole, the use of IPO protection terms that provided investors not only with downside protection, but also a premium on the unicorn price, increased compared to our prior survey. The average premium was 60% of the unicorn price.

- The per share price for the unicorn financings covered by this survey was, on average, 57 times higher than the per share price of such company’s Series A financing. This multiple is obviously very large, and could result in early stage investors having different views of a company’s preferred liquidity time frame and strategic path than later stage investors.

- As with our prior survey, investors in the financings covered by this survey continued to receive more “downside” protection for acquisitions than for IPOs. This could result in investors in unicorns whose value subsequently declines receiving returns that will vary significantly depending on whether the company chooses an acquisition or IPO as its liquidity path. This could also cause early and late stage investors to have different views of a company’s preferred strategic path.

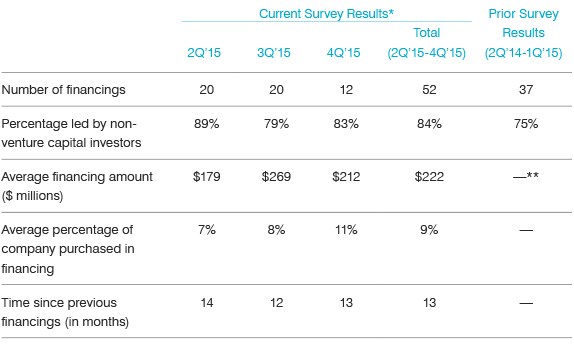

- The percentage of unicorn financings led by non-venture capital investors such as mutual funds and hedge funds increased to 84% during the period covered by the survey, and investors on average acquired 9% of the company in the unicorn financing.

Survey Results

The detailed results of our survey are as follows:

Financing Overview

* We note that breaking out data by quarter, as we have done in this survey, results in a more limited sample size for each individual quarter, but we felt that it was valuable to do so to see the trends over the course of the survey period.

** A blank line indicates that we did not collect this information in the prior survey.

Valuation Analysis

Price Change

* One company had a nearly 1700% up round in 4Q15. If this financing was excluded, the average per share percentage price increase from the prior financing round for 4Q15 would have been 121%.

Downside Protections — Acquisition Protection Terms

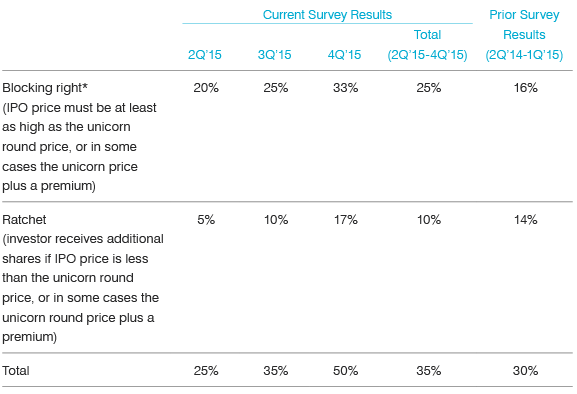

Downside Protections — IPO Protection Terms

* A “blocking right” means that the unicorn investors’ preferred stock will not automatically convert into common stock on an IPO unless the IPO price is at least as high as the previously agreed price. As the conversion of all preferred stock into common stock is almost always required for an IPO, if the agreed price is not met the company and investors will need to resolve the issue. This can result in the issuance of additional shares to the unicorn investors as consideration for the investors agreeing to convert their shares of preferred stock into common stock.

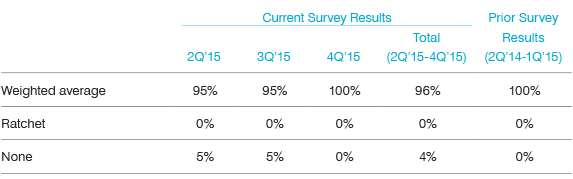

Future (Non-IPO) Financing Downside Protection Terms

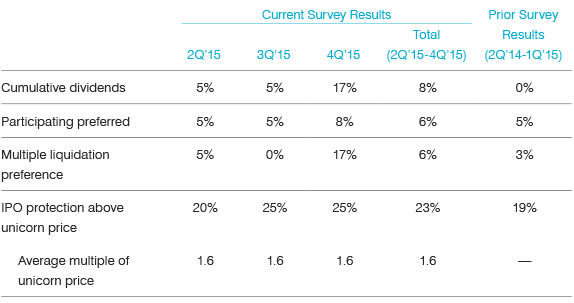

Upside Benefits

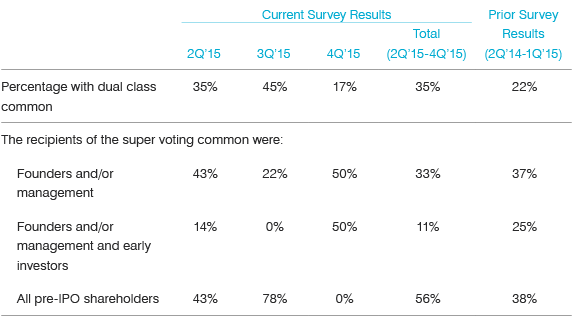

Super Voting Stock

Concluding Thought

Although this report focuses on the rights provided to investors in unicorn financings, it is important to understand that these rights are not permanent or unchangeable. Rather, investors can lose these rights in certain circumstances, most notably as part of future financings in which investors who do not participate in the financing can be deprived of previously granted rights (“pay to play financings”). The use of pay to play financings increases during downturns in the venture environment, when it is more difficult for companies to raise capital and companies look for ways to encourage investment. And even if investors have sufficient voting rights or financial ability to protect their rights in pay to play financings, companies in need of additional funds might find it necessary to provide new investors liquidation or other rights superior to their unicorn (and other) investors to attract needed capital. This happened frequently when the dotcom bubble burst in the early 2000s. Although the use of structures that reduce or eliminate outstanding investor rights is uncommon during most of the venture cycle, they become more common during significant downturns in the venture economy.